PLEDGE NOW!

Mission Fund Drive At-a-Glance

Why I Love East Shore

Did you miss any of the testimonials from our members? Listen to all of them here:

David Langrock

Bennett & Jan Anderson

Jeanne Gardiner

Nicky Woolwine

Milly Mullarky

Kristi Weir

Leta Hamilton

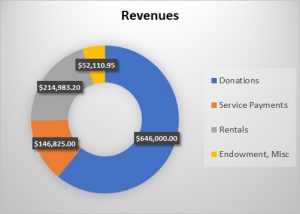

Our Preliminary Financial Outlook for FY2020-21

Regularly recurring pledge payments form the bedrock of ESUC’s financial foundation.

Goal: $625,000

Current fiscal year’s pledges total $593, 599.36

For next fiscal year, the goal for pledges is $625,000, a 5% increase from what was committed for current fiscal year.

It is important to note, to have a balanced budget with no significant cuts to programming or staff, and not have to invest in the operating budget using additional endowment funds (based on the preliminary budget), pledges would have to be $784,047.28

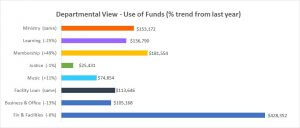

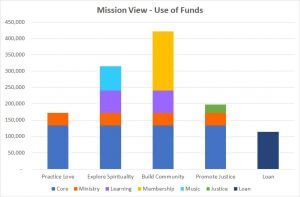

How East Shore Uses Resources: East Shore pays staff salaries and benefits, operates and maintains our property, makes an impact for justice through our ministry efforts, and supports the larger UU movement.

Assumptions:

- Practice Love: 25% Ministry, 25% Core

- Explore Spirituality: 25% Ministry, 100% Music, 50% Learning, 25% Core

- Build Community: 25% Ministry, 100% Membership, 50% Learning, 25% Core

- Promote Justice: 25% Ministry, 100% Justice, 25% Core

- Loan: 100% Loan

Still have questions about how we put together the budget? Watch this video made by our Executive Director, Jason Puracal.

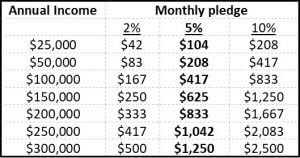

What Should I Give?

As members, we have a shared responsibility for the financial support of our church. Your pledge is a personal choice you must decide based on your current life and financial circumstances. For many, a pledge of 5% can be easily reached or surpassed. For others, such a goal may be difficult. If so, please consider making an initial pledge of 2% or 3% and increasing it, as your circumstances permit. If you can afford to pledge more, you will help others who are unable to do so. Use the following chart of monthly payments to help choose the amount right for you:

When you model generosity, you light a path for others to follow. By matching your values with your dollars, you benefit yourself as well as others because your actions match your aspirations. Giving feels good, and generous giving feels even better! ESUC needs and appreciates your generous giving. If you have any questions or concerns, or need a waiver from pledging, please talk to our Membership Development Manager, Nicole Duff.

Sustainable Giving

Sustainable Giving helps East Shore sustain church operations for the foreseeable future. As our operating costs increase, Sustainable Giving has an option for annual percentage increases in giving. A small increase can make a huge difference in our five to ten year financial plan. We are asking everyone who is comfortable with sustained giving to become a Sustainable Giver starting this year.

You simply pledge as normal, and indicate you’d like to become a Sustainable Giver and how much you’d like your pledge to increase in subsequent years. For example, if you are giving $200 a month and sign up for a 5% increase, the following year you would give $210 a month.

Questions? Talk to Membership Development Manager, Nicole Duff.

How Can I Pay My Pledge?

There are many pledge payment options: Automatic Bank Withdrawal (ACH), Credit Card, Check, Cash and others. However you choose to pay, we very much value your contribution! Our website has details of how to perform each method of payment.

- For cost efficiency, we urge every member to sign up for monthly Automatic Bank Withdrawals. Payments will be made effortlessly until you decide to change or stop them. The easiest way to set up an automatic bank withdrawal is to attach a voided check to your updated pledge form.

- Other payment methods are much less efficient or cost the church money. Credit cards charge 2-4% fees.

- Weekly or monthly cash or checks require significant manual bookkeeping effort.

Special Methods to Consider

The new tax law makes it more likely people will benefit from taking a now higher standard deduction on their tax return. There are a few ways you may be able to maximize the impact of your giving, and your deduction! Please consult your tax advisor first before using these methods.

- Donor Advised Funds (DAF) – Donors make a bulk donation to their account (and benefit from high itemized deductions), and distribute the money to non-profit organizations over several years.

- Payroll Deductions and Employer Matching Gifts: Some members have opted to utilize incentive programs at their place of employment to fulfill their pledge. If your employer excludes religious organizations, you may be able to utilize a third-party workplace giving application such as Benevity.

- IRA Distributions – If you are receiving income from an Individual Retirement Account, you may be able to use pre-tax IRA distributions to pay East Shore, saving you taxes on that portion of your income.

If you have questions on any of these types of methods, please reach out to Membership Development Manager, Nicole Duff and she can put you in contact with a member already doing this!

However you choose to pay, we very much value your contribution! Please contact Vanessa, East Shore’s Bookkeeper for any issues related to your payments.