Pledge Now

Fill Out the Form

Why I Give

Hope Grows Here

We, bearers of the dream, affirm that a new vision of hope is emerging.

We pledge to work for that community in which justice will be actively present.

We affirm that there is struggle yet ahead.

Yet we know that in the struggle is the hope for the future.

We affirm that we are co-creators of the future, not passive pawns.

And we stand united in affirmation of our hope and vision of a just and inclusive society.

We affirm the unity of all persons:

We affirm brotherhood and sisterhood that allows us to touch upon each other’s humanity.

We affirm a unity that opens our eyes, ears, and hearts to see the different but common forms of oppression, suffering, and pain.

Yet we are one in the image of God, and we celebrate our hopes for human unity.

Within ourselves and within the gathered community, we will discover the strength not to hide in indifference.

Affirming that hope, publicly expressed, energizes and enables us to move forward. Together we pledge action to transcend barriers — be they racial, political, economic, social, or religious.

We pledge to make our tomorrows become our todays.

– By Loretta Williams from “Been in the Storm So Long”

Beloveds,

Hope is what has carried us these past few years. Hope for a new minister, hope for growth, hope for healing, hope for surviving a global pandemic. Hope has kept us together, and hope is what will lead us forward. I often think of those people who went through these past three years alone. How lonely it had to be, how scared it must have been to face those struggles alone. Here, we are not alone. Here we have community. Here is where hope grows.

Hope is so badly needed right now. We are not only still dealing with the pandemic, but we are seeing the impact of the reversal of Roe v. Wade and the battles for individuals to maintain their bodily autonomy. We have seen new legislation that causes real harm to the LGBTQiA+ community, specifically trans youth who are being denied the opportunity to live their true selves. Even here in Bellevue, we are surprised and saddened by the reactions to our Pride service in June and the defacing of our Welcoming Congregations banner. We face the never-ending threat to our environment, wars tearing apart families, and continued injustices to our BIPOC siblings. It can often feel overwhelming, and we all need a place where we can find the comfort and support we need to continue to fight these battles with love.

In the past year, we have gotten to know one another better, reaffirming our commitment to be in community and spread our message of love and inclusivity inside and outside our doors. We are a safe haven for those looking to be accepted for who they are… all of who they are. The world needs East Shore and all we have to offer and plan to offer in the coming year.

Your support helps us continue to have meaningful, inspiring, and sometimes challenging services. Services filled with beautiful music, imaginative time for all ages, and the opportunity to recommit to our covenant. Your support helps make the coffee on Sundays, keep the buildings clean and maintained, and provide wonderful events like the Ingathering, Women’s Perspective Retreat, Seabeck, covenant circles, and so much more. Your support helps us live our Unitarian Universalist values by paying our hard-working staff an equitable salary so they can support their family and loved ones. Your support means hope.

We are asking you to please consider increasing your pledge by 5% to help us continue to put hope into the world. As you plant the seeds enclosed, think of your investment as planting hope for the future of East Shore so we can continue to be a beacon of light for decades to come.

Pledge Now

Fill Out the Form

What Should I Give?

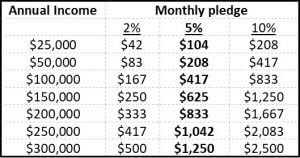

As members, we have a shared responsibility for the financial support of our church. Your pledge is a personal choice you must decide based on your current life and financial circumstances. For many, a pledge of 5% can be easily reached or surpassed. For others, such a goal may be difficult. If so, please consider making an initial pledge of 2% or 3% and increasing it, as your circumstances permit. If you can afford to pledge more, you will help others who are unable to do so. Use the following chart of monthly payments to help choose the amount right for you:

When you model generosity, you light a path for others to follow. By matching your values with your dollars, you benefit yourself as well as others because your actions match your aspirations. Giving feels good, and generous giving feels even better! ESUC needs and appreciates your generous giving. If you have any questions or concerns, or need a waiver from pledging, please talk to our Director of Membership Development, Nicole Duff.

Sustainable Giving

Sustainable Giving helps East Shore sustain church operations for the foreseeable future. As our operating costs increase, Sustainable Giving has an option for annual percentage increases in giving. A small increase can make a huge difference in our five to ten year financial plan. We are asking everyone who is comfortable with sustained giving to become a Sustainable Giver starting this year.

You simply pledge as normal, and indicate you’d like to become a Sustainable Giver and how much you’d like your pledge to increase in subsequent years. For example, if you are giving $200 a month and sign up for a 5% increase, the following year you would give $210 a month.

Questions? Talk Director of Membership Development, Nicole Duff.

How Can I Pay My Pledge?

There are many pledge payment options: Automatic Bank Withdrawal (ACH), Bill Pay, Credit Card, Check, Cash and others. However you choose to pay, we very much value your contribution!

- For cost efficiency, we urge every member to sign up for monthly Automatic Bank Withdrawals. Payments will be made effortlessly until you decide to change or stop them. The easiest way to set up an automatic bank withdrawal is to attach a voided check to your updated pledge form.

- Other payment methods are much less efficient or cost the church money. Credit cards charge 2-4% fees.

- Weekly or monthly cash or checks require significant manual bookkeeping effort.

Special Methods to Consider

The new tax law makes it more likely people will benefit from taking a now higher standard deduction on their tax return. There are a few ways you may be able to maximize the impact of your giving, and your deduction! Please consult your tax advisor first before using these methods.

- Donor Advised Funds (DAF) – Donors make a bulk donation to their account (and benefit from high itemized deductions), and distribute the money to non-profit organizations over several years.

- Payroll Deductions and Employer Matching Gifts: Some members have opted to utilize incentive programs at their place of employment to fulfill their pledge. If your employer excludes religious organizations, you may be able to utilize a third-party workplace giving application such as Benevity.

- IRA Distributions – If you are receiving income from an Individual Retirement Account, you may be able to use pre-tax IRA distributions to pay East Shore, saving you taxes on that portion of your income. You will see this listed as NonDeductible on your statement, and should receive a separate tax statement from your IRA account.

If you have questions on any of these types of methods, please reach out to Director of Membership Development, Nicole Duff and she can put you in contact with a member already doing this!

However you choose to pay, we very much value your contribution! Please contact Rebecca Chatfield, Director of Finance and Operations for any issues related to your payments.